GROWTH STRATEGIES

Private equity demands growth strategies outside the walls of traditional operations.

The fast pace of such demands needs all the access in one place to drive your investment of targets and acquisitions.

DELIVERING RESULTS

From Assessment to Exit Readiness

Five steps to help you DIGITALIZE

1.

Assess where you are on the digital spectrum and develop a strategic roadmap

2.

Upgrade & modernize core functions with digital capabilities

As increasing amounts of data become available and need to be digested, digital tools, like RPA and Data & Analytics capabilities can be used by your firm and your portfolio companies to upgrade core functions. These tools can be deployed to streamline and boost the efficiency of your internal operations, including tax reporting, onboarding, security, regulatory compliance, and investor communications. This will become even more essential if or when you expand globally.

3.

Embed digital capabilities into your process for choosing target companies

Utilize Data & Analytics and cognitive capabilities to help you become more efficient and timely with:

- Locating potential targets

- Assessing their value and how they stack up against the competition

- Making a reasonable offer that will generate an acceptable return

4.

Employ digital capabilities to help manage, optimize and/or merge portfolio companies

5.

Develop a talent strategy

You need a team with digital and analytical skills to plan and execute your transformation strategy. Assessing your existing personnel to determine if they have the appropriate expertise to plan and execute roadmap is a critical step. Can they be trained, or are you better off recruiting new talent? Or should you retain the services of a firm that already possesses appropriate tools, technology and personnel? You should get input on this decision from all key stakeholders, including human resources, IT, operations, project oversight, etc.

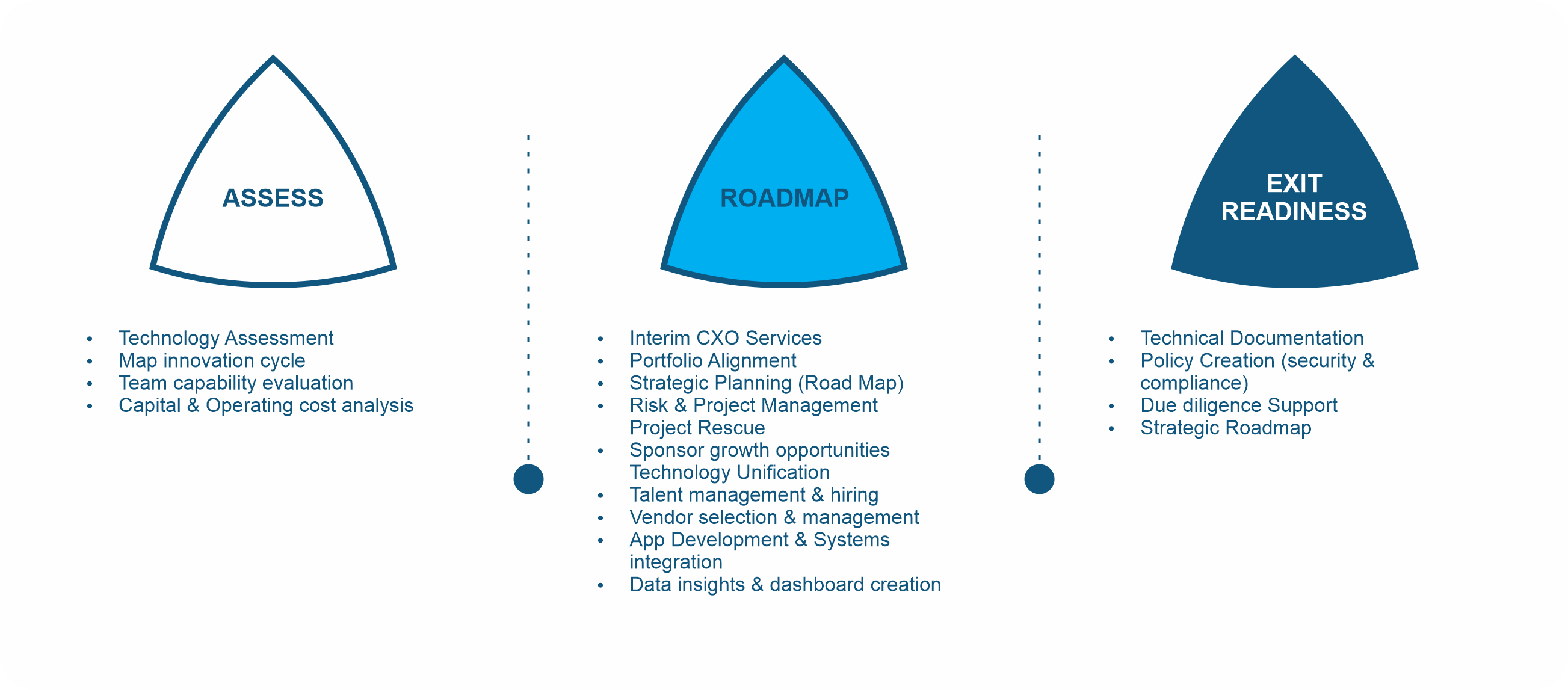

ASSESS

Know where you are and plan

how to reach your desired state

ROADMAP

Chart your transformation

journey (and the cost)

READINESS

Maximize the returns on

exit valuations to maximize IRR